Growth of 15% in its subscriber base and satisfied customers—these are the results obtained by IT-INVEST, a Ukrainian ISP, thanks to EU support. The company took advantage of an EU4Business-EBRD Credit Line to purchase much-needed equipment and develop infrastructure for uninterrupted Internet service throughout the city and beyond.

Being online is vital during lockdowns

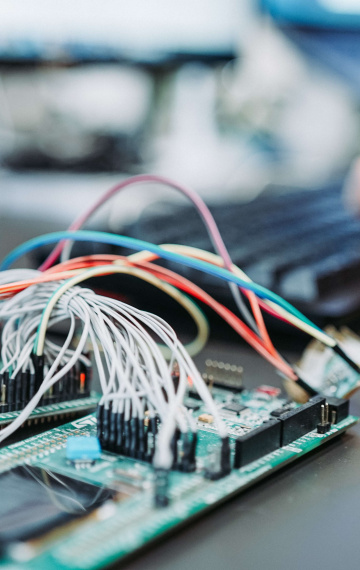

Since 2010, IT-INVEST has been providing fibre-optic broadband services. Its customers include over 2,400 organisations and about 5,000 households. During the pandemic, a high-quality Internet connection has become vital for most users who need to work or study remotely. For this reason, IT-INVEST decided to upgrade its equipment for customers to enjoy a faster Internet connection. This was possible through OTP Leasing, one of the Partner Financial Institutions under the EU4Business-EBRD Credit Line.

"Our team understands the utmost importance of being online,” says IT-INVEST Director Natalia Dashevska. “Our support service not only provides a round-the-clock Internet connection, but also solves problems for the most demanding customers.”

The importance of IT-INVEST's work is clear, especially since many regions in Ukraine still lack sufficient broadband coverage. At the end of 2020, the Ministry of Digital Transformation unveiled its National Strategy for the Development of Broadband Internet Access (BIA). It was preceded by a detailed nationwide survey, which showed that, as of May 2020, 85.2% of Ukrainians had access to a fibre-optic Internet connection. At the same time, the numbers were much smaller in rural areas, at 55.4%. The National Strategy aims to provide technical access for 95% of the population to enjoy the broadband connection speed of at least 100 Mbps. This meant that IT-INVEST's efforts to upgrade its equipment to improve broadband services during the pandemic have been very well timed.

Growth opportunities for every economic sector

The EU4Business-EBRD Credit Line is a joint initiative of the EU and EBRD focused on Eastern Partnership countries. It provides SMEs with the opportunity to invest in new equipment and technologies to comply with EU Directives. In Ukraine, more than 280 SMEs in various economic sectors, from agriculture to construction, have already taken advantage of the initiative. Significantly, nearly 90% of the projects are in the regions.

Via local Financing Partner Institutions, like OTP Leasing in case of IT-INVEST, SMEs can take out three types of loans. The Standard and Simplified Approaches involve loans up to €300,000 for simple equipment upgrades and up to €3 million for investing for almost any business in almost any sector. SMEs can also win grants of up to 15% on eligible financing amounts or get free technical assistance provided by an international team of engineers.